Recently, Zuosi released the "2019 and Global Automotive Wiring Harness, Connector and Cable Research Report".

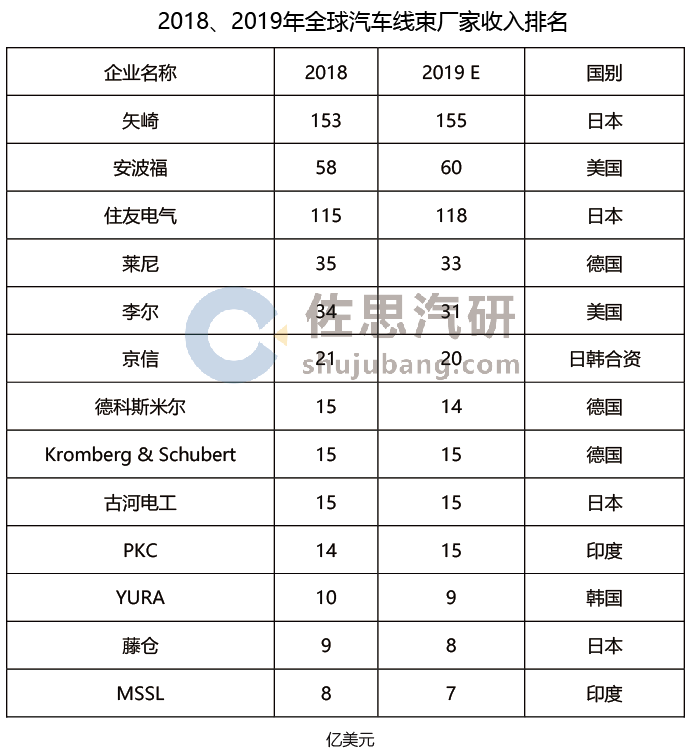

Global automotive wiring harness companies can be divided into four echelons. The first echelon is only Yazaki and Sumitomo Electric, with revenues of more than $ 10 billion. Yazaki focuses on endogenous development, while Sumitomo Electric relies on cooperation and mergers and acquisitions.

Sumitomo Electric Subsidiary Sumitomo Denso SWS and Indian company Samvardhana Motherson form a joint venture MSSL. MSSL continues to acquire in the field of online harnesses. In 2014, it acquired Stoneridge in the United States for US $ 67.5 million, and in 2017 it purchased the commercial vehicle harness for 570 million euros. PKC, Germany's Leoni recently suffered a loss, MSSL intends to acquire Leoni, once the acquisition is successful, Sumitomo Group's wiring harness business income will surpass Yazaki to reach the world's first.

The second echelon includes Ambofo, Leni and Lear. Apollo's main investment is in the field of active safety, but Apollo will separate the high-voltage wiring harness department from the wiring harness division. Lear's main business is car seats, which account for more than 75% of its revenue. It is likely that the electrical division will be independent or sold in the future.

The third echelon includes Jingxin, De Cosmere, Kromberg & Schubert, Furukawa Electric, Yu Luo and Fujikura. Jingxin is a joint venture between South Korea's Jingxin and Sumitomo Electric. The fourth echelon has many small wire harness companies.

The global automotive connector market size was approximately US $ 17.8 billion in 2018, with an average value of approximately US $ 193 per vehicle, a significant increase from US $ 169 in 2017. On the one hand, it is due to the rise in copper prices in 2017, and the lag in price increases by major manufacturers, and on the other hand, the surge in new energy vehicle sales. The average value of each new energy vehicle connector is about $ 500-800. Especially in the initial stage, manufacturers lack experience in designing new energy vehicles. In order to ensure safety, they have to use more expensive connectors as much as possible, and have more safety redundancy considerations. The more experienced OEMs, the fewer the number of high-voltage wiring harnesses and connectors they use. Then there is the increase in the use of connectors per vehicle. Almost every new hardware function requires several or even a dozen connectors. This is also the main driving force for the automotive connector market in the future.

Unfortunately, OEMs are also working to reduce the use of connectors. The automotive connector market is expected to grow by 0.6% in 2019 to reach $ 18.5 billion, mainly due to the decline in automobile sales, and the leading connector Tyco has experienced a significant decline. It is estimated that in 2020, global automobile sales will increase, and at the same time, there will be more manufacturers entering the pure electric vehicle market for the first time, and the market will increase by 3.9%. It is expected to reach a market size of USD 23.6 billion by 2024.

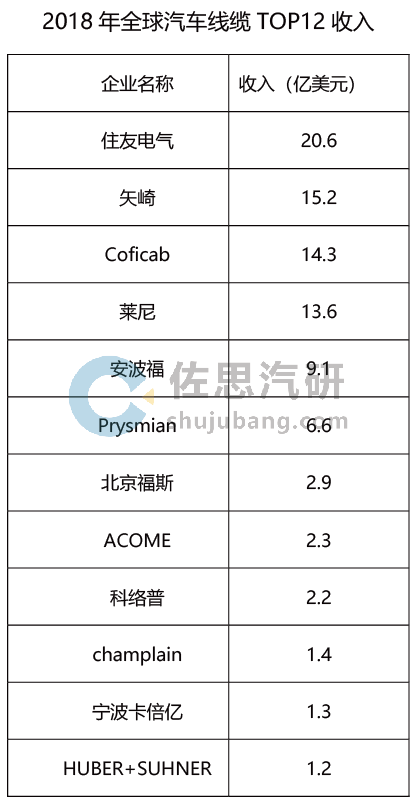

Large wire harnesses and Japanese and Korean manufacturers such as Yazaki, Sumitomo, Fujikura, Furukawa, YURA, Ampofu, and Leoni have the ability to produce cables, especially Japanese manufacturers have strong cable production capabilities and excellent technology. stand by. New energy vehicle high-voltage cables are also capable of producing.

2019 China and Global Automotive Wiring Harness, Connector and Cable Research Report

01

Automotive wiring harness and connector market

1.1 Global Automotive Market

1.2 Chinese Automotive Market

1.3 Global New Energy Vehicle Market

1.4 China's New Energy Vehicle Market

1.5 China's New Energy Passenger Car Market Structure

1.6 Chinese New Energy Commercial Vehicle Market Structure

1.7 Global Automotive Wiring Harness and Connector Market

1.8 China Automotive Wiring Harness and Connector Market

1.9 Global Segmentation of High Voltage Wiring Harnesses and Connectors for New Energy Vehicles

1.10 China's Global New Energy Vehicle High Voltage Wiring Harness and Connector Market Segmentation

02

Automotive wiring harness and connector industry pattern

2.1 Revenue Ranking of Global Automotive Wiring Harness Manufacturers in 2018, 2018 and 2019

2.2 Global high-voltage automotive wiring harness industry pattern

2.3 Global New Energy Vehicle High Voltage Connector Industry Structure

2.4 China Automotive Wiring Harness Industry Structure

2.5 Market Structure of High Voltage Wiring Harnesses and Connectors for New Energy Vehicles in China

2.6 Global Automotive Cable Industry Structure

2.7 Supporting relationship between China's new energy high-voltage wiring harness / connectors and OEMs

03

Automotive wiring harness and connector technology analysis

3.1 New Energy Vehicle Connector Standard

3.2 Design of high-voltage connectors for new energy vehicles

3.2.1 Design of high current contacts

3.2.2 High pressure resistance design

3.2.3 Overall structural design

3.3 Design of Automotive Wiring Harness System

3.4 Introduction to high-voltage wiring harnesses for new energy vehicles

3.5 Overall design of high-voltage wiring harness

3.5.1 Shielding Performance Design

3.5.2 Mechanical protection and dustproof and waterproof design

3.5.3 Service life design

3.6, high-voltage wiring harness requirements

3.7 Introduction and standard status of high voltage cables

04

Automotive Wiring Harness and Connector Manufacturers

4.1 Aptiv

4.2 Sumitomo Electric

4.3 BizLink

4.4 Lear

4.5 Shanghai Jinting (Yongding)

4.6 Yazaki

4.7 Furukawa

4.8 Fujikura

4.9 Lenny

4.10 De Cosmere

4.11 Huguang

4.12, Kromberg & Schubert

4.13 Nexans

4.14 Derun Electronics

4.15 Yura

4.16, Jingxin Industry

4.17 Gouda Auto Parts

4.18 Tianhai Automotive Electronics

4.19 Changchun Sanzhi

4.20, Auto-Kabel

4.21 Qiaoyun Technology

4.22 Tianjin Lean

4.23 Samvardhana Motherson Group

4.24 MD Elektronik

4.25, Prettl

4.26 Forschner

05

Automotive connector manufacturers research

5.1 Amphenol

5.2 Hu Lian

5.3 Rosenberg

5.4, JAE

5.5 Tyco Electronics

5.6 Nanjing Conny Electromechanical

5.7 Sichuan Yonggui Technology

5.8 AVIC Optoelectronics

5.9 Lixun Precision

5.10, JST

06

Automotive Cable Manufacturer Research

6.1 Ningbo Kabeiyi

6.2 Beijing FOSS Automotive Wires

6.3 Hengtong New Energy

6.4 COFICAB

6.5 Colop

6.6, Draka (Prysmian)

6.7, HUBER + SUHNER

Chart Catalog

Global car sales, 2016-2022

Geographical distribution of global light vehicle sales, 2016-2019

Geographical Distribution of Global Bell Car Sales 2016-2019

Passenger Car Sales in China, 2011-2021

Global New Energy Vehicle Sales, 2012-2021

China New Energy Vehicle Sales and Growth Rate 2015-2021

Distribution of China's New Energy Vehicle Sales by Type, 2015-2021

Size Distribution of China's Pure Electric Vehicle Market in the First Half of 2019

Size Distribution of China's PHEV Market in the First Half of 2019

Global automotive wiring harness market size, 2017-2024

Global Automotive Connector Market Size, 2017-2024

Global high-voltage wiring harness market size and growth rate, 2017-2024

The downstream distribution of the global high-voltage wiring harness market, 2017-2024

Tesla high-voltage connector cost location distribution

Market Share of Major Global New Energy Vehicle High Voltage Connector Manufacturers in 2019

Revenue of Chinese Automotive Wiring Harness TOP20 Manufacturers, 2018

TOP12 global automotive cable revenue in 2018

Automotive wiring harness design flowchart

Typical vehicle wiring harness module for fuel vehicle

Connection of high voltage system of pure tram

Aptiv's quarterly order business segment from Q1 2017 to Q2 2019

Aptiv customer distribution in 2019

Aptiv's Expected Revenue Distribution by 2022

2018 Aptiv ADVANCED SAFETY & USER EXPERIENCE Revenue by Region and Product Distribution

2018 Aptiv SIGNAL & POWER SOLUTIONS Revenue by Region and Product Distribution

Revenue of Sumitomo Electric Wiring Harness Business, 2014-2019

Revenue of BizLink Automotive Wiring Harness Business, 2014-2019

Lear's Revenue, Net Margin, and Number of Employees, 2014-2019

Revenue Distribution of Lear, 2014-2019

Revenue and Operating Margin of Lear Electric System, 2014-2019

Revenue, Region, and Product Distribution of LEAR Electrical System Business in 2018

Lear Electric System Product Distribution

Typical application of Lear Electric System

Revenue and Gross Margin of Jinting Harness, 2016-2020

Customer Distribution of Shanghai Jinting in 2018

Major products of Furukawa Automotive

Furukawa High Voltage Harness Development Direction

Revenue and Operating Margin of Fujikura, 2009-2018

Geographical Distribution of Fujikura's Revenue in 2018

Geographical Distribution of Leoni's Revenue, 2017-2019

Basic principle of Loni Y connector

Loni EMC Filter

Revenue of Deksmir 2014-2018 (millions of euros)

Customer Distribution of Kunshan Shanghai Optoelectronics in 2018

Revenue of Nexans, 2010-2018

Number of Nexans employees, 2010-2018

Copyright ©2020-2022 New Port Electric Co., Ltd All Right Reserved Technical Support:品牌设计